Africa New and Changed Reports

These reports were released on 25 June.

The P16b is a summary report for the reconciliation of tax deductions made in the tax year.

The P16b-1 is a detail report that shows the tax deductions made per employee.

The tax values on these reports must balance back to the tax values as reported on the employee’s tax certificate.

The report includes employees with YTD+ Gross Income in the current tax year greater than zero or if the employee has a YTD+ Tax Deduction value unequal to zero.

Because these two reports have the same purpose and use the same data, we only added one new report to the Lesotho Reports Menu.

When you run the P16b report, it will create both the P16b and P16b-1 reports.

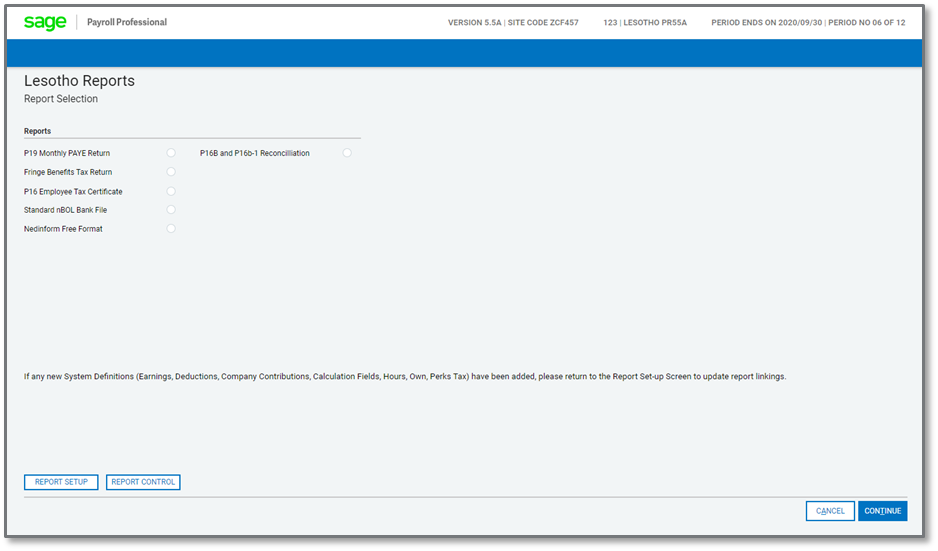

The new P16b & P16b-1 report is available on the Lesotho Reports Screen.

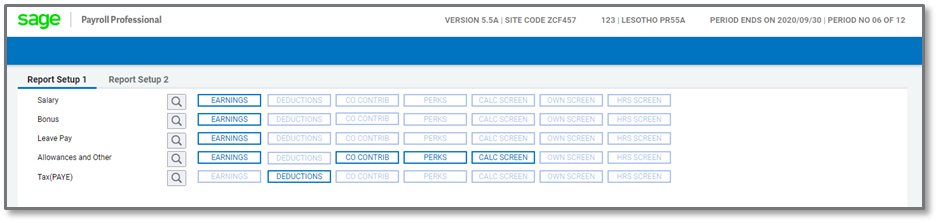

Before using the report, you must complete the Report Setup.

On the Report Setup, you must link the applicable Payroll Definition Lines to the selection fields for Salary, Bonus, Leave Pay, Allowances and Other and Tax\PAYE.

After completing all the Report Selections, you can select to run the report.

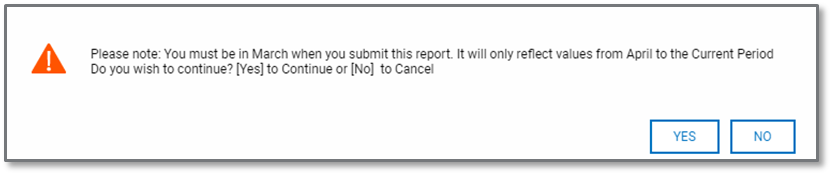

You will get a warning message which informs you that the report must rather be run in the last period of the tax year as the report requires YTD+ values for the tax year, e.g. April to March.

Select <Yes> if you want to create the report.

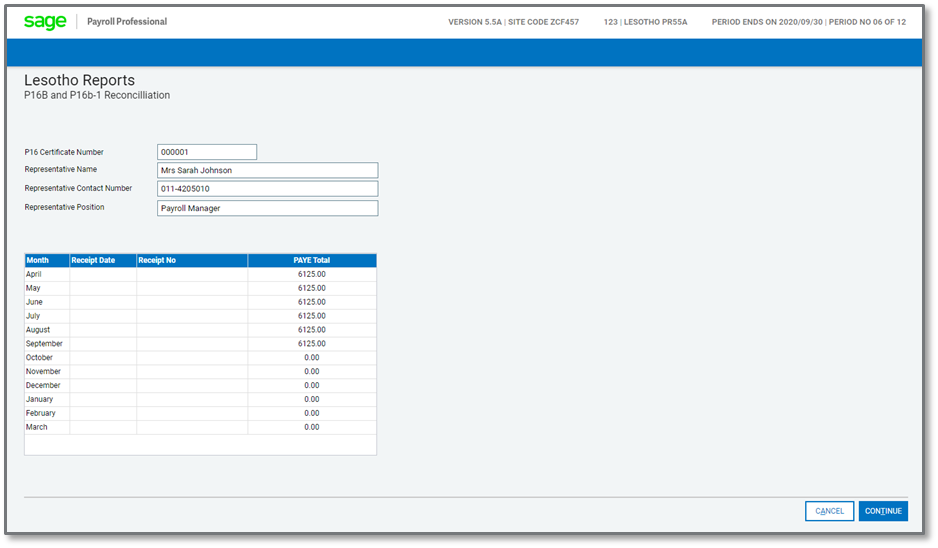

After selecting to continue, additional information is required and must be completed to create the reports with the correct required values.

The following fields must be completed:

|

Field |

Description |

|---|---|

|

P16 Certificate Number |

Enter the 6-digits where the certificate numbering must start - the rest of the employees will have a sequential number following from the number entered. A pre-fix, LRA, is then automatically added to the numbers that are generated. For example: enter the first number, e.g. 098082. First certificate number will be LRA098082. The next certificate number will be LRA098083. Note: Please make sure to use the same starting number as entered when creating the actual P16 tax certificates. |

|

Representative Name |

Enter the name of the person responsible for submitting this return. |

|

Representative Contact Number |

Enter the contact number of the person responsible for submitting this return. |

|

Representative Position |

Enter the position or job title of the person responsible for submitting this return. |

|

Reconciliation Grid |

In the grid section, capture the relevant month’s PAYE payment date and the receipt that was issued for the payment. The PAYE value pulls through from the YTD+ tax values as deducted from employees. |

Once all the fields are completed, you can continue to create the report.

The report will be saved in the location selected on the report input screen. The report will consist of two sheets – one for the P16b and the other for the P16b-1 report.

This report was released on 14 July.

Zambia has introduced a new statutory contribution called The National Health Insurance (NHI) under The National Health Insurance Act No.2 of 2018.

This is a health insurance scheme which entitles contributing members to a predetermined set of healthcare benefits. The effective date of the contribution was 01 October 2019.

The NHI Employee Schedule, e.g. NHIMA_CONTRIBUTIONS.xlsx file is used to make submissions of employee’s NHI Contributions on a monthly basis and the submission deadline is the 10th of the following month.

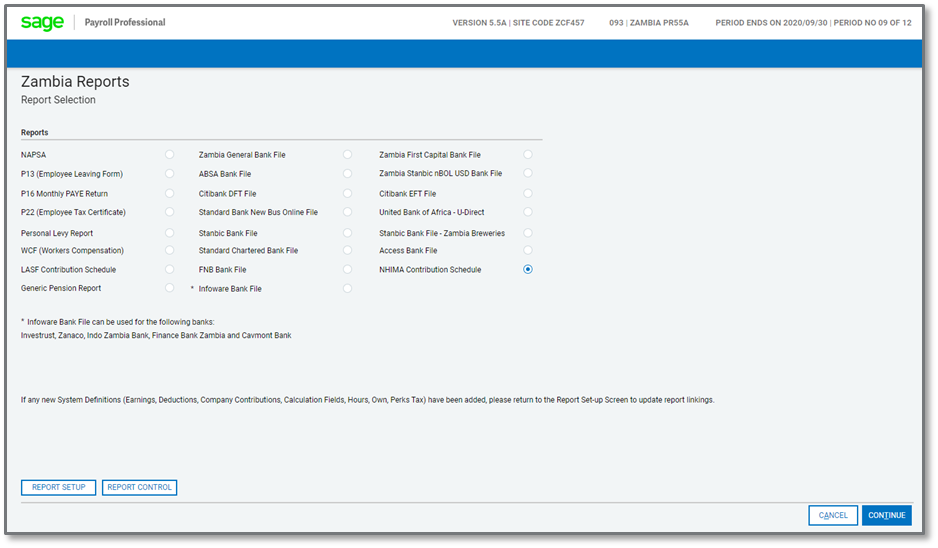

The new NHI report is available on the Zambia Report Screen.

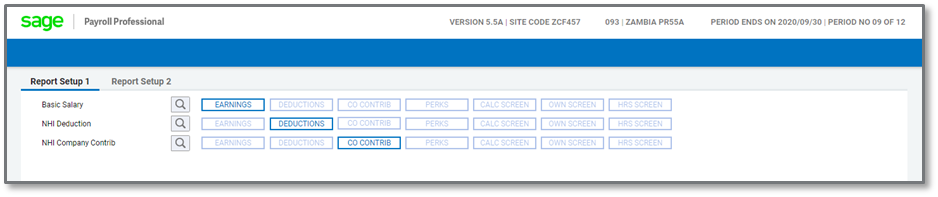

Before using the report, you must complete the Report Setup.

On the Report Setup, you must link the applicable Payroll Definition Lines to the selection fields for Basic Salary, NHI Deduction and NHI Company Contribution.

After completing all the Report Selections, you can select to run the report.

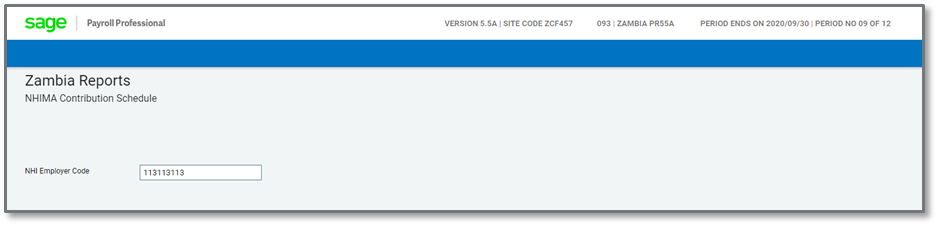

After selecting to run the report, additional information is required and must be completed to create the reports with the correct required values.

The following fields must be completed:

|

Field |

Description |

|---|---|

|

NHI Employer Code |

Enter the employer code allocated to the company by the NHI. |

Once all the fields are completed, you can continue to create the report. The report and submission file will be saved in the location selected on the report input screen.

The MRA is responsible for the collection of contributions/payments to the Portable Retirement Gratuity Fund (PRGF).

Employers are required to submit a monthly PRGF return and effect payment in respect of PRGF contributions to the Director-General of the MRA.

The MRA has put in place a system for e-Filing of a monthly PRGF return. There are two options available for the submission of the return:

-

"SCREEN INPUT" where users want to capture manual input on the e-Filing system or a

-

CSV file as per MRA’s specifications.

Employers with more than 100 employees in their PRGF return must use CSV file for submission of their return for that period.

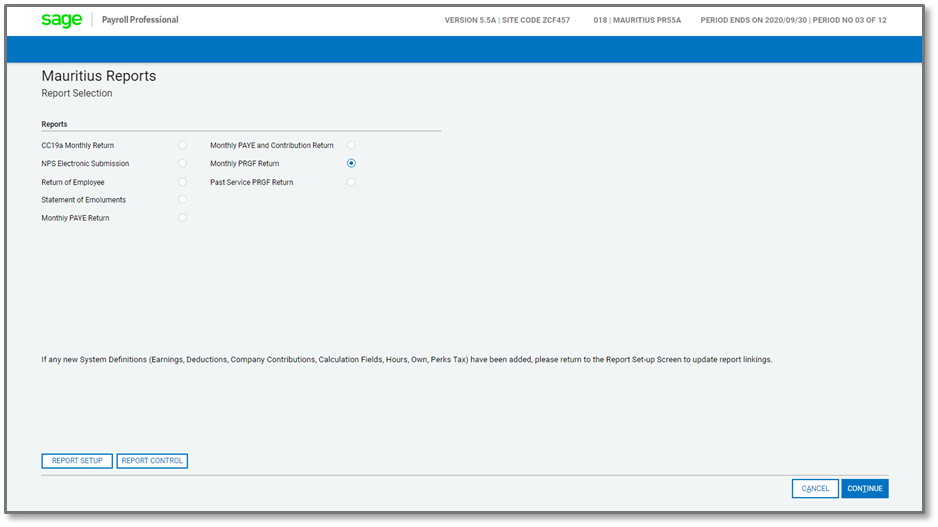

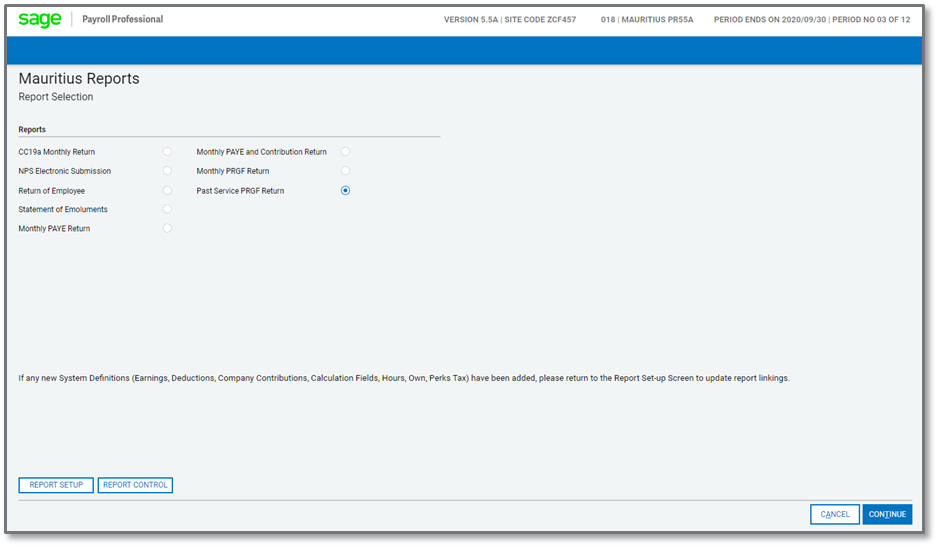

The new PRGF Monthly Submission File report is available on the Mauritius Reports Screen.

Before using the report, you must complete the Report Setup.

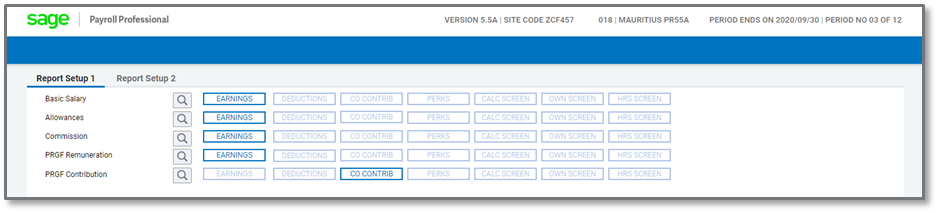

On the Report Setup, you must link the applicable Payroll Definition Lines to the selection fields for Basic Salary, Allowances, Commission, PRGF Remuneration and the PRGF Company Contribution.

After completing all the Report Selections, you can select to run the report.

After selecting to run the report, additional information is required and must be completed to create the reports with the correct required values.

The following fields must be completed:

|

Field |

Description |

|---|---|

|

Mobile Number |

Enter the company mobile number – please note the file only allows for an 8-digit number. |

|

Employer’s Representative |

Enter the name of the person responsible for submitting this return. |

Once all the fields are completed, you can continue to create the report. The report and submission file will be saved in the location selected on the report input screen.

The PRGF is effective 1 Jan 2020 but the employees are covered from the time they were employed – this is the past period the report refers to.

To contribute for that past period, the employer has the option to make contributions based on employees’ income as of December 2019.

The employer can make these past payments at any time during employment based on December 2019 income or make past payments when an employee is terminated based on the income received in the month of termination.

In this report, we need employees who have the Past Payment PRGF Contribution amount.

If the employer started to contribute from April 2020, they will print this if they want to make payments for the months since the start of employment. Payments can be lump sums or instalments.

They will eventually do away with this report, but there is no date yet.

The effective date is still 1 Jan 2020 (not April 2020), but employers can make late payments for the months of January to March, because there was a delay in on the admin side of the PRGF.

You will have to run the Monthly Return for that in the respective month because the Past Services Return is based on Dec 2019 income.

The new PRGF Past Service Return File report is available on the Mauritius Reports Screen.

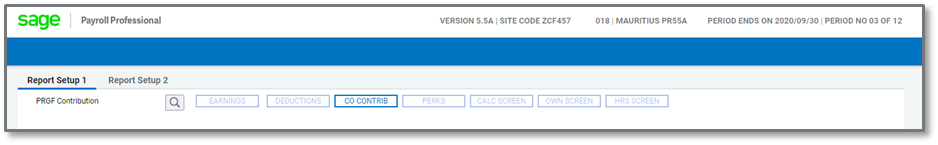

Before using the report, you must complete the Report Setup.

On the Report Setup, you must link the applicable Payroll Definition Lines to the selection fields for Past Service PRGF Contribution.

After completing all the Report Selections, you can select to run the report.

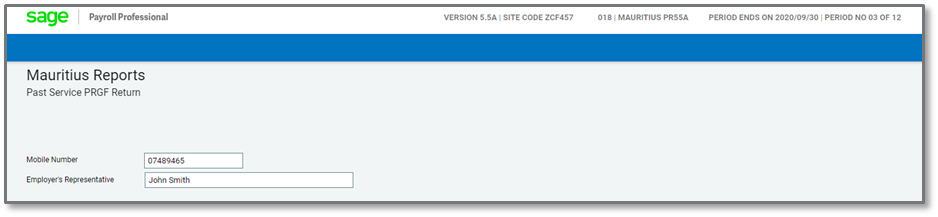

After selecting to run the report, additional information is required and must be completed to create the reports with the correct required values.

The following fields must be completed:

|

Field |

Description |

|---|---|

|

Mobile Number |

Enter the company mobile number – please note the file only allows for an 8-digit number. |

|

Employer’s Representative |

Enter the name of the person responsible for submitting this return. |

Once all the fields are completed, you can continue to create the report.

The report and submission file will be saved in the location selected on the report input screen.

The following issues have been resolved or the changes have been made to existing reports:

|

Country |

Report |

Detail |

|---|---|---|

|

Botswana |

ITW10 & ITW10a Report |

The report was incorrectly including employees with zero YTD+ values. |

|

Botswana |

ITW10 & ITW10a Report |

There was a spelling mistake on the ITW10 Summary Report for the word “Remuneration”. |

|

Botswana |

ITW7a Online Submission File |

The severance pay gratuity value was not populating the CSV file nor the actual report. Additional employees cleared on report. This change was released on 23 June. |

|

Botswana |

ITW8 Tax Certificate |

When there are more than 1000 transactions in the report, an error was generated, and the tax certificates could not be created. |

|

Ghana |

111A & 111B Report |

The incorrect Social Security Contribution value was printing on the report – the report was updated to print the YTD+ Retirement Relief Amount as calculated on the employee’s Tax Screen. |

|

Kenya |

iTax P10 Submission File |

Column heading for Deposit on Home Ownership Saving Plan updated on the Reconciliation Report. |

|

Namibia |

PAYE5 Tax Certificate |

When the employee’s Tax Start Date differs from the employee’s Date Engaged, the report was incorrectly printing the Date Engaged instead of the Tax Start Date. |

|

Eswatini (previously Swaziland) |

PAYE Reconciliation Submission |

The submission file layout was updated with the latest template requirements for the submission for the 2020 tax year as provided by the revenue authority. |

|

Tanzania |

Monthly SDL Report |

In July 2020, the SDL contribution rate was changed from 4.5% to 4%. The report was updated to print the new SDL contribution rate. |

|

Tanzania |

Half year SDL Report |

In July 2020, the SDL contribution rate was changed from 4.5% to 4%. The report was updated to print the new SDL contribution rate. |

|

Zambia |

P22 Report |

Updated the report lookup descriptions, because some of the descriptions were outdated. |

|

Zambia |

Barclays Bank File |

The Barclays Bank File was renamed to refer to ABSA instead of Barclays. |

|

Zimbabwe |

NSSA P16 Annual Return |

Effective 1 June 2020, the NSSA Insurable Income Limit was changed from 700.00 per month to 5000.00 per month. The report was updated to print the old value of 700.00 per month from January 2020 to May 2020. From June 2020 onwards, the earning limit will default from a user input field when running the report – the current default value is 5 000.00. This change was released on 23 June. |

|

Zimbabwe |

NSSA P4 Report |

Effective 1 June 2020, the Total NSSA Contribution Rate increased from 7% to 9%. The NSSA P4 Report was updated to print 9% instead of 7% in the Total NPS column. This change was released on 23 June. |